In today’s increasingly digital world, businesses of all sizes need reliable and secure solutions to process payments online.

One company that has consistently positioned itself at the forefront of the global payment processing industry is Paysafe. With over two decades of experience, Paysafe has been delivering innovative payment solutions for businesses and consumers. Whether you’re a small business owner looking to simplify transactions or a large corporation seeking an enterprise-level payment solution, Paysafe aims to meet all your payment processing needs.

This in-depth review will explore Paysafe’s features, its strengths, pricing structure, and how it compares with other industry players, helping you decide whether it is the right fit for your business.

Overview of Paysafe

Paysafe is a multinational payment processing company that has evolved over the years to offer an array of services. Founded in 1996 and headquartered in London, Paysafe initially built a name for itself by providing online payment solutions for a wide range of industries. Today, it operates in more than 50 countries and offers services to businesses across various sectors, including e-commerce, gaming, travel, digital goods, and more. The company’s global footprint allows it to deliver solutions tailored to specific regional needs, while still offering the same level of security and efficiency on a global scale.

Paysafe is also known for its well-established consumer brands, such as Skrill, Neteller, and paysafecard. Each of these brands plays a distinct role in the payment ecosystem, ensuring that businesses have access to a variety of payment processing options.

Key Services Offered by Paysafe

- Credit and Debit Card Processing – Accepting all major credit and debit cards, Paysafe allows businesses to process payments quickly and securely. Whether it’s Visa, Mastercard, or American Express, Paysafe supports all major card providers.

- Digital Wallets – Paysafe’s digital wallets, like Skrill and Neteller, enable users to store funds and make secure, quick payments online. These wallets are especially useful for frequent online shoppers and gamers who want to keep their payment methods handy.

- Prepaid Vouchers – Paysafe’s paysafecard is a prepaid voucher solution that allows consumers to make online payments without the need for a bank account or credit card. It’s a great option for individuals who are wary of online banking or who prefer cash-based transactions.

- Bank Transfers – Paysafe supports direct bank transfers, providing businesses with another secure and reliable method of payment. This is particularly useful for larger transactions, where credit card processing fees may be too high.

- Alternative Payment Methods – As part of its commitment to catering to different regions and consumer preferences, Paysafe also offers a wide range of alternative payment methods. These include localized payment solutions tailored to specific markets, ensuring that customers worldwide can pay in the most convenient way possible.

Features of Paysafe

Paysafe offers a comprehensive suite of features designed to streamline payment processing for businesses, regardless of size. Here’s an overview of its most prominent features:

1. Global Reach and Scalability

One of the standout features of Paysafe is its ability to provide payment solutions on a global scale. The company’s network supports transactions in over 50 countries and across multiple currencies, making it an ideal solution for businesses looking to expand internationally. With an infrastructure built for scale, Paysafe ensures that businesses can accept payments from customers anywhere in the world, without worrying about local banking restrictions or incompatible payment methods.

2. Security and Compliance

Security is a top priority for Paysafe. The company utilizes cutting-edge encryption technologies to protect sensitive data during every transaction. In addition, Paysafe is fully compliant with global regulatory standards, such as the Payment Card Industry Data Security Standard (PCI DSS). This ensures that businesses and consumers alike can trust Paysafe with their financial data.

3. Advanced Fraud Protection

Paysafe’s payment solutions are equipped with advanced fraud detection mechanisms, ensuring that transactions are secure and legitimate. The system uses machine learning algorithms and real-time analytics to identify suspicious activity, helping businesses minimize fraud risk. This makes it a great choice for industries like gaming and e-commerce, where chargebacks and fraud can significantly impact profitability.

4. Developer-Friendly Tools and Integration

For businesses looking to integrate payment processing into their websites or mobile apps, Paysafe offers a suite of developer tools, including APIs, SDKs, and pre-built solutions. These tools make it easy to incorporate Paysafe’s payment solutions into any platform, whether it’s a small e-commerce store or a large enterprise system.

The API is flexible and can be customized to meet specific business needs, while the SDKs are easy to implement for developers who want to get started quickly. With these tools, businesses can create a seamless, branded payment experience for their customers.

5. Mobile Payment Solutions

As more consumers turn to mobile devices for shopping and payments, Paysafe has adapted to meet this demand. The company’s mobile payment solutions allow businesses to accept payments from smartphones and tablets, ensuring that transactions can be completed quickly and efficiently no matter where customers are.

6. Reporting and Analytics

Paysafe provides businesses with a powerful suite of reporting and analytics tools. These tools help businesses track sales, view transaction histories, analyze trends, and gain valuable insights into customer behavior. By utilizing these features, businesses can make data-driven decisions that can help improve their bottom line.

Ease of Use

One of the key reasons why many businesses choose Paysafe is because of its ease of use. The platform is designed to be user-friendly, making it easy for both business owners and customers to process payments without confusion.

Merchant Dashboard

The Paysafe merchant dashboard provides a centralized location for businesses to manage their payments, transactions, and customer data. The dashboard is designed with usability in mind, making it simple for businesses to keep track of their financial activities. From the dashboard, merchants can view transaction history, access reporting tools, and even manage refunds and chargebacks.

Consumer Experience

On the consumer side, Paysafe ensures that making payments is a hassle-free experience. Whether customers are paying via credit card, digital wallet, or prepaid voucher, the payment process is quick and straightforward. The system is intuitive and doesn’t require extensive steps, making it easy for consumers to make payments in just a few clicks.

Mobile Compatibility

In today’s fast-paced world, many consumers prefer to make payments on their mobile devices. Paysafe has responded to this demand by ensuring that its services are fully optimized for mobile devices. Whether customers are paying through the Paysafe mobile app or directly on a business’s mobile-optimized website, the payment process is smooth and efficient.

Customer Support

Paysafe offers multiple channels for customer support, including email, phone, and live chat. While the support team is generally responsive and helpful, some users have reported delays in response times. It’s important for businesses to provide detailed information when reaching out to support to help expedite the resolution process. Paysafe’s support team is available 24/7, so businesses can get assistance at any time.

Pricing Structure

Paysafe’s pricing is competitive, but it varies depending on the services used and the volume of transactions. The company typically charges a fee for processing credit and debit card payments, as well as for transactions made through digital wallets and other payment methods. Additional fees may apply for services such as currency conversion, chargebacks, and fraud protection.

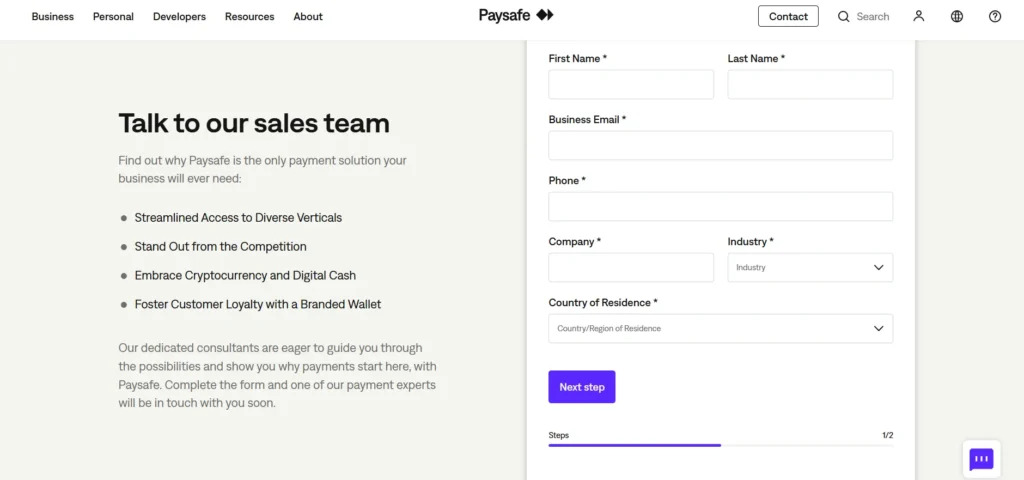

For businesses looking for a more customized solution, Paysafe offers tailored pricing based on the company’s needs. This means that businesses should contact Paysafe directly for a quote specific to their requirements.

Pros and Cons of Paysafe

Pros:

- Global Reach: Paysafe’s ability to accept payments from customers worldwide makes it an excellent choice for businesses with an international customer base.

- Security: With industry-leading encryption technology and robust fraud protection, Paysafe ensures secure transactions for both businesses and consumers.

- Developer Tools: The company’s developer-friendly tools, such as APIs and SDKs, make integration into websites and mobile apps easy.

- Multiple Payment Methods: Paysafe supports a variety of payment methods, including credit and debit cards, digital wallets, prepaid vouchers, and bank transfers.

- Scalability: Paysafe can handle businesses of all sizes, from small startups to large corporations, making it a flexible choice for any company.

Cons:

- Customer Support: Some users report slow response times and difficulty in resolving complex issues.

- Fees: While generally competitive, fees can accumulate for businesses processing a high volume of transactions.

- Complex Pricing Structure: The pricing structure can be confusing, and businesses may need to request a customized quote to fully understand the costs.

Final Thoughts

Paysafe offers a comprehensive suite of payment processing solutions for businesses across a range of industries. Its global reach, security features, and developer tools make it an attractive option for businesses looking to streamline their payment processes. However, potential users should be mindful of the pricing structure and may need to contact Paysafe directly for a tailored quote based on their specific needs.

Overall, Paysafe’s combination of reliability, security, and scalability makes it a solid choice for businesses in 2025. Whether you’re looking for simple card processing or a more complex payment solution, Paysafe is well-equipped to meet your needs.

FAQs

Is Paysafe suitable for small businesses?

Yes, Paysafe offers flexible pricing and scalable solutions that cater to businesses of all sizes, including small businesses.

How secure is Paysafe?

Paysafe uses state-of-the-art encryption and fraud detection technology to ensure that all transactions are secure. It is also compliant with global regulatory standards like PCI DSS.

Can I use Paysafe to process international payments?

Yes, Paysafe supports transactions in over 50 countries, making it an ideal solution for businesses looking to accept international payments.

What are the fees associated with using Paysafe?

Paysafe charges fees based on the services used and the volume of transactions. Businesses should contact Paysafe directly for a tailored quote.

How can I integrate Paysafe into my website or app?

Paysafe offers APIs and SDKs that make it easy to integrate their payment solutions into your website or app.